Feb 6, 2024 | Buyers, Financing

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?

The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play.

Inflation and the Federal Reserve

The Federal Reserve (Fed) doesn’t directly determine mortgage rates. But the Fed does move the Federal Funds Rate up or down in response to what’s happening with inflation, the economy, employment rates, and more. As that happens, mortgage rates tend to respond. Business Insider explains:

“The Federal Reserve slows inflation by raising the federal funds rate, which can indirectly impact mortgages. High inflation and investor expectations of more Fed rate hikes can push mortgage rates up. If investors believe the Fed may cut rates and inflation is decelerating, mortgage rates will typically trend down.”

Over the last couple of years, the Fed raised the Federal Fund Rate to try to fight inflation and, as that happened, mortgage rates jumped up, too. Fortunately, the expert outlook for inflation and mortgage rates is that both should become more favorable over the course of the year. As Danielle Hale, Chief Economist at Realtor.com, says:

“[M]ortgage rates will continue to ease in 2024 as inflation improves . . .”

There’s even talk the Fed may actually cut the Fed Funds Rate this year because inflation is cooling, even though it’s not yet back to their ideal target.

The 10-Year Treasury Yield

Additionally, mortgage companies look at the 10-Year Treasury Yield to decide how much interest to charge on home loans. If the yield goes up, mortgage rates usually go up, too. The opposite is also true. According to Investopedia:

“One frequently used government bond benchmark to which mortgage lenders often peg their interest rates is the 10-year Treasury bond yield.”

Historically, the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has been fairly consistent, but that’s not the case recently. That means, there’s room for mortgage rates to come down. So, keeping an eye on which way the treasury yield is trending can give experts an idea of where mortgage rates may head next.

Bottom Line

With the Fed meeting later this week, experts in the industry will be keeping a close watch to see what they decide and what impact it’ll have on the economy. To navigate any mortgage rate changes and their impact on your moving plans, it’s best to have a team of professionals on your side.

Jan 8, 2024 | Buyers, Financing

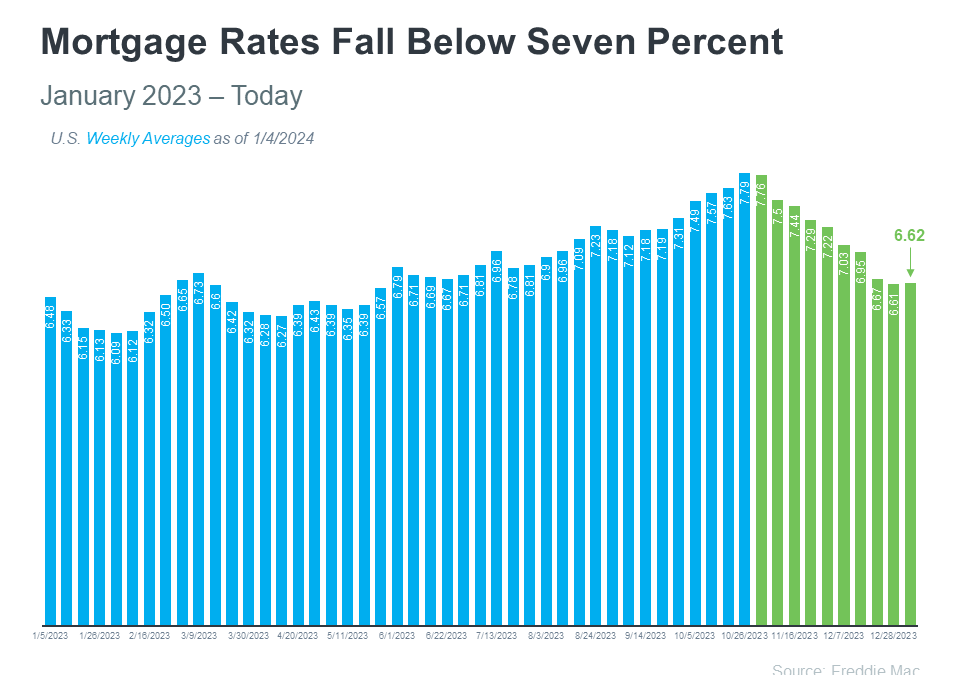

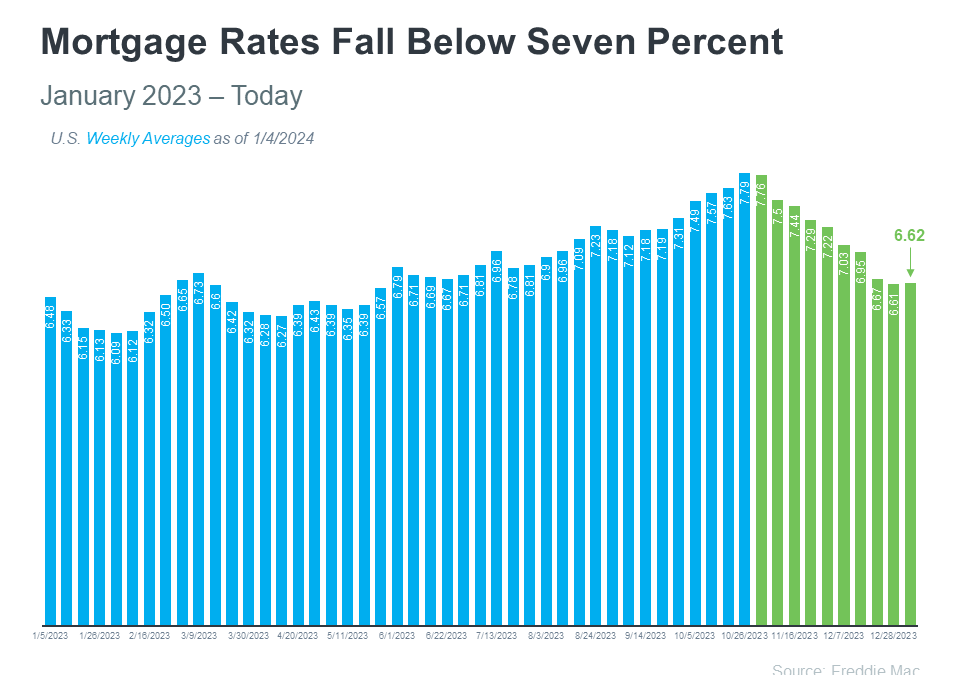

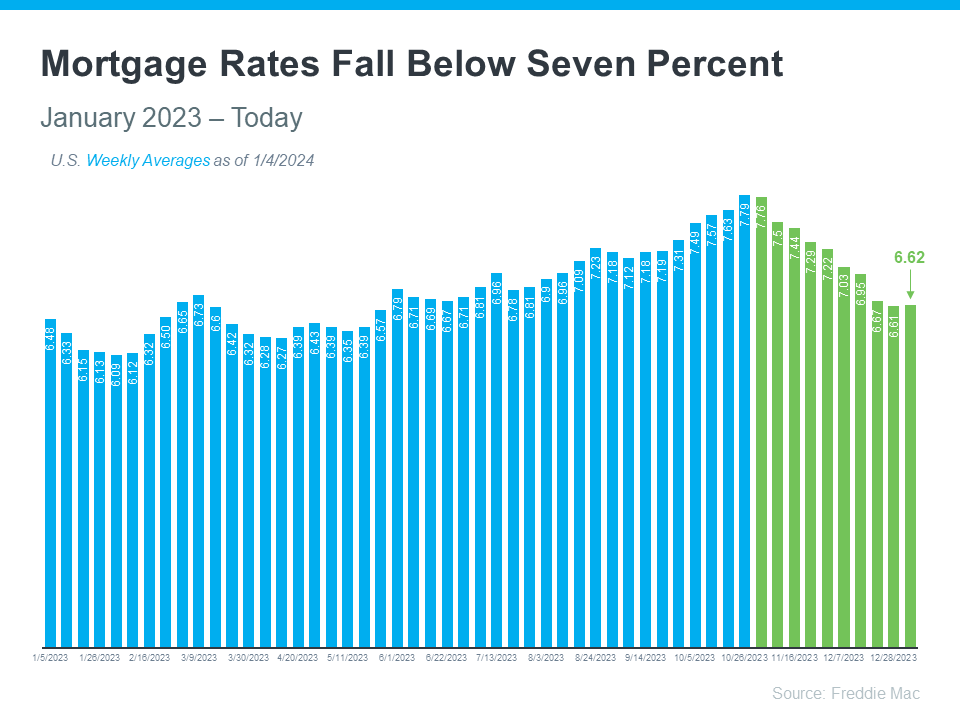

If you want to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Affect Your Search for a Home

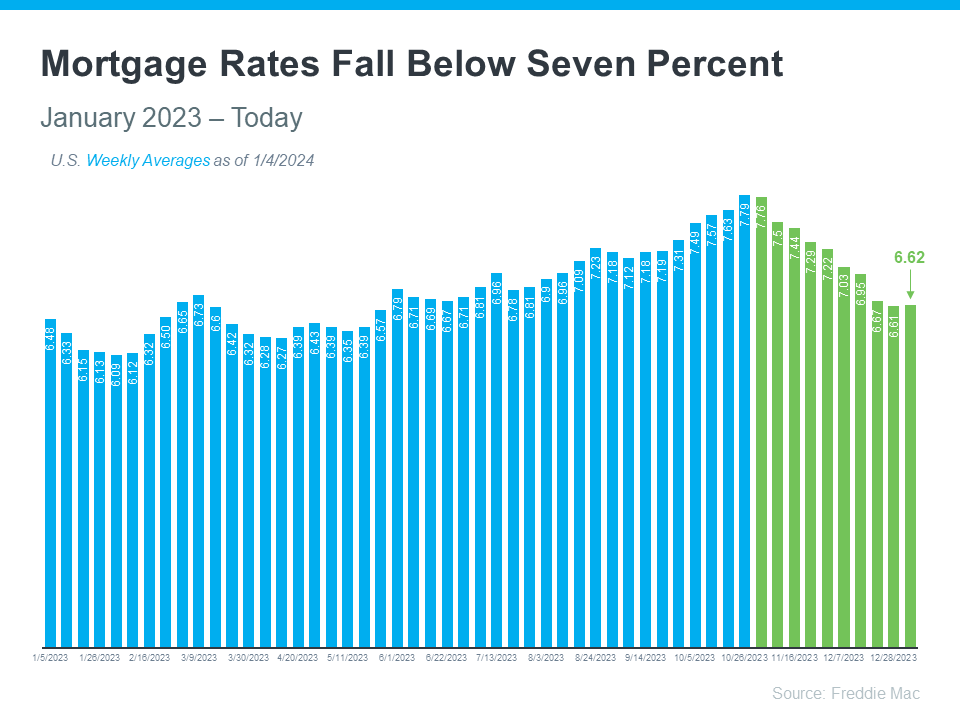

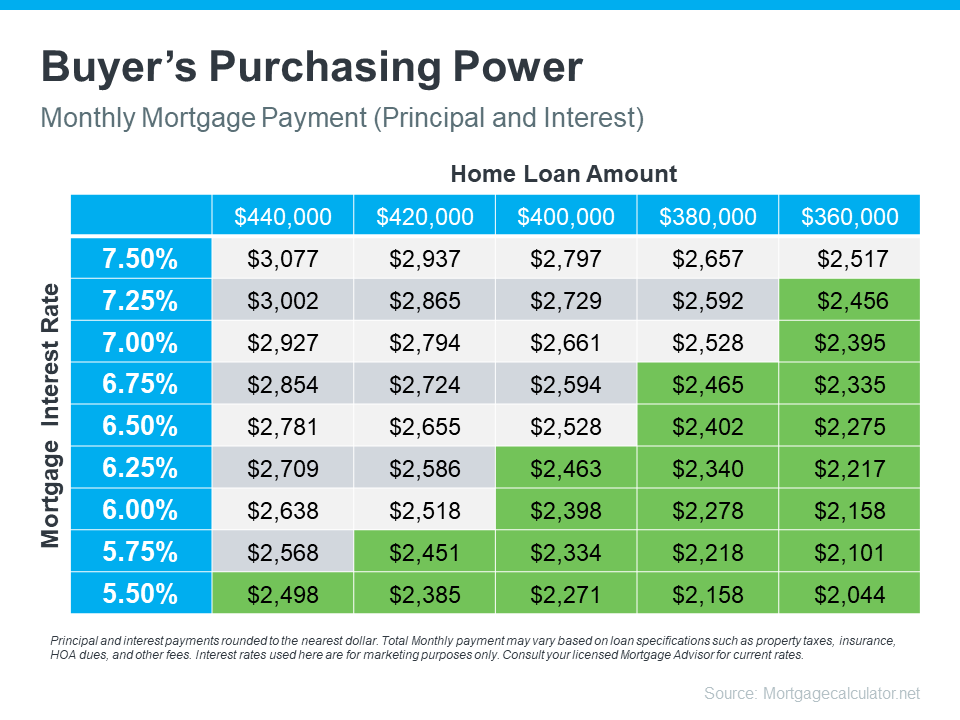

Understanding the connection between mortgage rates and your monthly home payment is crucial for your plans to become a homeowner. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. Imagine your budget allows for a monthly payment between $2,400 and $2,500. The green part in the chart shows payments in that range or lower (see chart below):

As you can see, even small changes in rates can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When you’re looking to buy a home, it’s important to get guidance from a local real estate agent and a trusted lender. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together, then adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

If you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

Jan 8, 2024 | Buyers, Financing, Uncategorized

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future all-season patio, be sure you’re working with a trusted lender to prioritize this essential step. Here’s why.

While home price growth is moderating and mortgage rates have been coming down in recent weeks, affordability is still tight. At the same time, there’s a limited number of homes for sale right now, and that means ongoing competition among hopeful buyers. But, if you’re strategic, there are ways to navigate these waters – and pre-approval is the game changer.

What Pre-Approval Does for You

To understand why it’s such an important step, you need to know more about pre-approval. As part of the homebuying process, a lender looks at your finances to determine what they’re willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Getting pre-approved starts to put you in the mindset of seeing the bigger financial picture, one step at a time. And the key is actually more than just getting a pre-approval letter from your lender. The combination of pre-approval and strategic budgeting is your golden ticket to understanding what you can actually afford. It saves you from painful heartaches down the road so you don’t fall in love with a house that might be out of reach.

Pre-Approval Helps Show Sellers You’re a Serious Buyer

But that’s just the beginning. Let’s face it, there are more people looking to buy than there are homes available for sale, and that creates competition among homebuyers. That means you could see yourself in a multiple-offer scenario when you get ready to make your move. But getting pre-approved for a mortgage can help you stand out from other buyers.

In today’s fast-moving housing market, having that pre-approval in your back pocket can be your secret weapon. When sellers see you’re pre-approved, it tells them you’re a strategic and serious buyer. In a world of multiple offers, that’s a big deal. As an article from the Wall Street Journal (WSJ) says:

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Pre-approval shows sellers you’re more than just a window shopper. You’re a buyer who’s already undergone a credit and financial check, making it more likely that the sale will move forward without unexpected delays or issues. Sellers love that because they see your offer as a reliable one. A win-win, right?

Bottom Line

So, before you start mentally arranging furniture in your dream home, work with a trusted lender to get your pre-approval set. It’ll save you time, stress, and a lot of headaches that could come up along the way without it. The reality is, the more prepared you are, the more likely you are to land the home you’re longing for.

Jul 3, 2023 | Buyers, Uncategorized

Closing costs will vary, depending on the financing arrangement and on selling price of the home, and these are approximations. Typically, closing costs paid by the buyer include the following:

- Loan Origination Fee – 1% of the loan amount.

- Discount Points – 1% to 2% of the loan amount, depending on the mortgage interest rate.

- Appraisal Fee – $475

- Credit Report Fee – $50

- Pre-Paid Mortgage Interest – The interest pre-paid by the purchaser for the period between the closing date and the end of the current month.

- Hazard Insurance Premium – Lenders require that the hazard insurance be pre-paid for one year and that two additional months’ premium be held in escrow to cover the first two months of the following year. The first year’s premium is approximately .3% of the selling price.

- City / County Property Taxes – A reimbursement to the seller for pre-paid property taxes covering the period between the closing and the end of the tax period.

- Title Exam / Closing Fee – The attorney’s fee is generally $350 to $500.

- Title Insurance – A one-time premium, approximately .4% of the selling price.

- Private Mortgage Insurance – Insurance required by lenders, paid for by purchasers, for loans with loan to value ratio greater than 80%.

- Recording Fees & Taxes – These fees cover recording of the deed and the mortgage with the city or county and the state. They are approximately .4% of the selling price.

- Survey – The fee for the survey, if required, will be in the range of $200 – $250. The figure will be higher if acreage is involved.

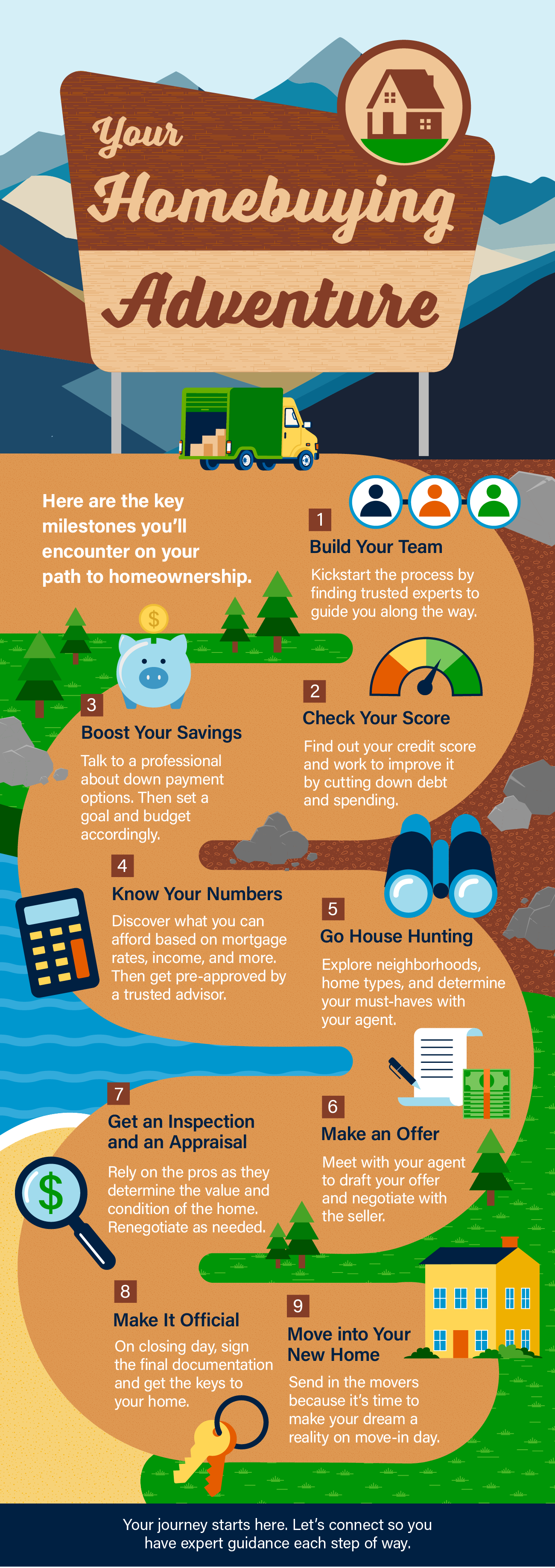

![Your Homebuying Adventure [INFOGRAPHIC]](https://micahallenrealtor.com/wp-content/uploads/2024/01/Your-Homebuying-Adventure-KCM-Share.png)