Writing the Offer

Congratulations! We found the right home…now what? Once you have found THE home …now I go to work helping you make a competitive offer based on market research. Terms that we will need to decide include: sales price of home, close date, seller contribution to closing costs and any other contingencies to the contract. I will advise you every step of the way.

- Review the Contract: The best way to prepare for the contract phase of the transaction as a buyer is to review a blank copy of the purchase contract. Reading the contract prior to making an offer will make you much more comfortable during the negotiation phase.

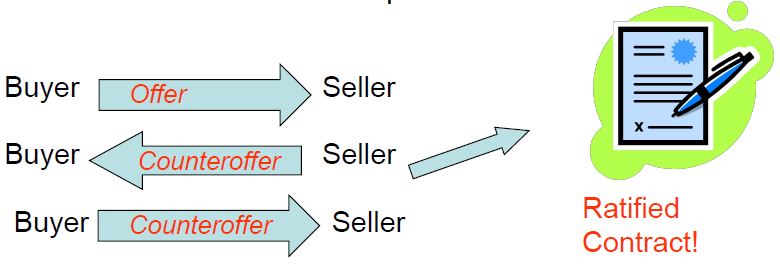

- Offer: While much attention is paid to the asking price of a home, a proposal to buy includes both the price and terms, as listed above. I will help guide you in the negotiation process as we work to come to an agreement for you and the seller.

- Seller contributions: Buyer may ask Seller to pay some of the closing costs.

- Strategies to make your offer competitive: Price, terms and conditions.

- I will explain the contract, attached forms and offer process to you.

- Be prepared:

- Have your mortgage pre-approval ready.

- Have your funds available – Earnest money deposit with contract.

- Ask questions about the contract and the process.

Understand What Goes into House Prices in a Competitive Market

Even in a seller’s market, home sales depend on certain factors that may require you to be flexible. Read

8 Simple Rules for Negotiating Your Offer and Getting That House

You and your agent are going to use everything you’ve learned to seal the deal. Read

Visit houselogic.com for more articles like this.

© Copyright 2023 NATIONAL ASSOCIATION OF REALTORS®